Is L.B. Foster Company (NASDAQ:FSTR) a good stock to buy right now? In order to answer this question we are going to take a look at what hedge funds and guru investors have been doing recently. According to Insider Monkey’s database of hedge fund holdings investors who are in the know are taking a bullish view. The number of long hedge fund positions advanced by 1 recently. Our calculations also showed that FSTR isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to analyze the new hedge fund action encompassing L.B. Foster Company (NASDAQ:FSTR).

What does the smart money think about L.B. Foster Company (NASDAQ:FSTR)?

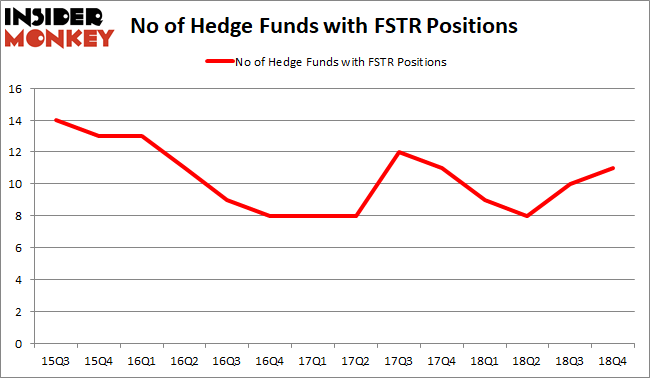

Heading into the first quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of 10% from one quarter earlier. On the other hand, there were a total of 9 hedge funds with a bullish position in FSTR a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, Legion Partners Asset Management was the largest shareholder of L.B. Foster Company (NASDAQ:FSTR), with a stake worth $16.7 million reported as of the end of September. Trailing Legion Partners Asset Management was Renaissance Technologies, which amassed a stake valued at $8.1 million. D E Shaw, Royce & Associates, and Ancora Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key money managers were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most valuable position in L.B. Foster Company (NASDAQ:FSTR). Marshall Wace LLP had $0.2 million invested in the company at the end of the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as L.B. Foster Company (NASDAQ:FSTR) but similarly valued. These stocks are Bel Fuse, Inc. (NASDAQ:BELFA), First Northwest Bancorp (NASDAQ:FNWB), Ohio Valley Banc Corp. (NASDAQ:OVBC), and Legacy Reserves LP (NASDAQ:LGCY). This group of stocks’ market values are similar to FSTR’s market value.

[table]

Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position

BELFA,4,5588,0

FNWB,2,14966,-1

OVBC,1,2148,0

LGCY,7,1499,1

Average,3.5,6050,0

[/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.5 hedge funds with bullish positions and the average amount invested in these stocks was $6 million. That figure was $33 million in FSTR’s case. Legacy Reserves LP (NASDAQ:LGCY) is the most popular stock in this table. On the other hand Ohio Valley Banc Corp. (NASDAQ:OVBC) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks L.B. Foster Company (NASDAQ:FSTR) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.